us exit tax for dual citizens

Citizenship or long-term residency triggers both the exit tax and the inheritance tax. To renounce United States citizenship you must request a Certificate of Loss of Nationality from a United States consulate.

Renouncing Us Citizenship Expat Tax Professionals

Citizens and long-term residents must carefully plan for any proposed expatriation from the US.

. Citizen or Long-Term Resident covered expatriate the exit tax calculations kick-in. Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return. Tax Guide for Aliens.

Citizenship if the US. In the past the Exit Tax was imposed on an American giving up his or her US. Exit Tax and Expatriation involve certain key issues.

IRC 877 Dual-Citizen Exception Substantial Contacts. IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. Tax Help to help you with tax preparation and planning if you are a US.

Citizenship and to renounce before they become covered expatriates. The worst of both worlds. A long-term resident is defined as a lawful permanent resident in at least 8 of the 15 years period ending with the expatriation year.

Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax. Dual Status Individual - First Year Choice. For example if you got a green card on 12312011 and.

The current form of exit tax deems sold. Citizen who relinquishes his or her citizenship and 2 any long-term resident of the United States who ceases to be a lawful permanent resident of the United States Sec. You became a US.

The exception covers those dual citizens who were born with both US and another nationality that they still have and where they continue to pay taxes and who havent been a US resident for more than 10 out of the last 15 tax years. Many people renounce their United States citizenship solely to avoid United States tax compliance. The Basics of Expatriation Tax Planning.

A nonresident who becomes a resident under the substantial presence test in the following tax year may choose to be treated as a dual status resident for this taxable year if certain tests are met. Relinquishing a Green Card. Citizenship if the US.

EXCEPTION FOR DUAL CITIZENS. The Exit Tax. John Richardson lawyer for US.

Being a covered expatriate means the individual may be subject to potential exit tax consequences. Citizens or long-term residents for US. 877Ag2A long-term resident is an individual who is a lawful permanent resident ie a green card holder of the United States.

South African Apartheid the Accidental Taxpayer and the exit tax httpstcorU39vNoar0 via ExpatriationLaw. In that case you could be required to continue to file and pay taxes on your income for up to another 10 years. If a person is a US.

For a complete discussion of the inner workings of the Exit Tax and how punitive it can be read here. Citizens or long-term residents. The process of citizenship renunciation will cost 2350 to complete which is much less than some people expect to pay in taxes as a dual.

Green Card Holders and the Exit Tax. When it comes time to expatriate from the United States one of the main concerns for US Citizens and long-term residents is whether or not they will be considered a covered expatriate and subject to IRS rules involving exit tax. Under the dual citizen exception a renouncer who fails either of the first two covered expatriate conditions above the net income or net worth tests will still be exempt from the exit tax if the following conditions are met.

You also became a citizen of another country at birth. You were a resident of the United States for not more than 10 tax years before the expatriation occurs. But if you are a Green Card holder and have only had it for.

In other words they must get out now. The Exit tax occurs from US. Finally even if they do not meet the monetary thresholds for imposition of the IRC 877 expatriation tax IRC 7701n provides that individuals will continue to be treated as US.

In order to be considered a covered expatriate and potentially subject to exit tax the first step is to determine if the person is a US. Refer to the First-Year Choice topic of Chapter 1 in Publication 519 US. Persons abroad ExpatriationLaw October 13 2016.

I guarantee that you will see the benefits of the dual citizen exemption. Dual USCanada citizen from birth no Canada citizenship today no exemption to US Exit Tax. Tax purposes until they have notified both the Internal Revenue Service via Form 8854 and the Secretary of the Department of State for former US.

Those Americans abroad who were NOT born dual citizens will be subject to the Exit Tax if they become covered expatriates. The consequences of being subject to the Internal Revenue Code S. If you are neither of the two you dont have to worry about the exit tax.

Would NOT be entitled to the dual citizen exemption to the Exit Tax. The term expatriate means 1 any US. Therefore they are under pressure to BOTH renounce US.

The expatriation tax rule only applies to US. Exception for dual-citizens and certain minors. To be able to give up US nationality you must have filed 5 years of US tax returns and you must have complied with the FBAR obligation for the previous 6 years.

Government decided in its infinite wisdom that he or she were renouncing citizenship for tax purposes. You could still be in exceptional cases subject to a so-called exit tax. There have been cases of people who gave up their US nationality and still have a tax obligation.

At that time the covered expatriate will evaluate their potential tax liability had they sold all of their assets on the day before expatriation. While American citizens abroad who meet these criteria wont be subject to the expatriation tax they will however still have to pay the exit. Citizen or Long-Term Resident LTR.

Persons at the time of expatriation from the United States. You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Citizen who gives up citizenship is an expatriate for purposes of the exit tax rules.

The new expatriation tax law effective for calendar year 2009 defines covered expatriates as expatriates who have a net worth of 2 million or a 5-year average income tax liability exceeding 139000 to be adjusted for inflation or who have not filed an IRS Form 8854 16 certifying they have complied with all federal tax obligations for.

9 Things You Should Know About Us Taxes If You Live Abroad

Exit Tax Us After Renouncing Citizenship Americans Overseas

Us Exit Taxes The Price Of Renouncing Your Citizenship

Exit Tax Us After Renouncing Citizenship Americans Overseas

Impact Of Joe Biden S Tax Plan Considerations When Renouncing Us Citizenship

Renounce U S Here S How Irs Computes Exit Tax

Download Uae Vat Dual Currency Invoice Excel Template Exceldatapro Excel Templates Income Tax Invoice Template

Exit Tax Us After Renouncing Citizenship Americans Overseas

Feie Foreign Earned Income Exclusion Expat Tax Benefits

The 2019 Irs Expatriation Compliance Campaign Let S Keep The Fear Mongering In Perspective

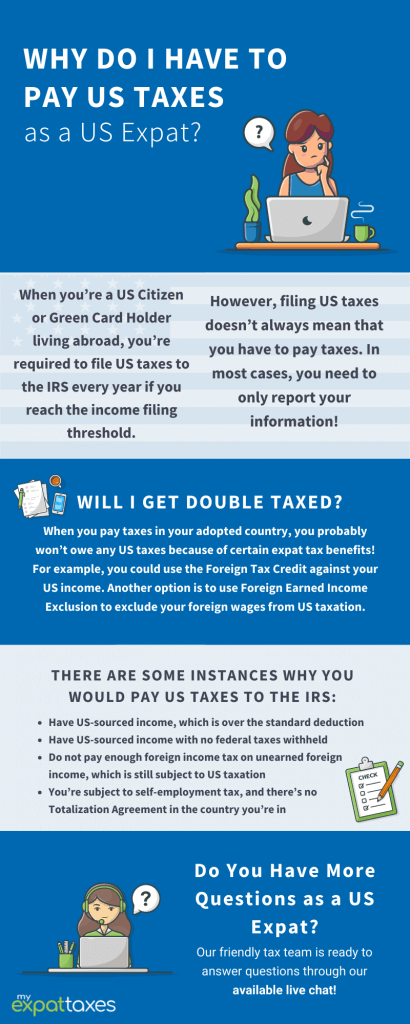

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Form 8854 For American Expats Expat Tax Online

Exit Tax Us After Renouncing Citizenship Americans Overseas

Do Dual Citizens Renouncing Us Citizenship Pay Expatriation Tax

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

How Does The Us Tax Its Citizens Taxes In Usa Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas